Tesla's Earnings Miss: Musk's sideshow vs. the actual numbers

The Sideshow Completely Swallowed the Circus

Let's be clear about one thing: Tesla's Q3 earnings call wasn't really about earnings. Sure, there were numbers. Record revenue, which is great. Missed profit targets, which is not. The stock slid a few points after hours, which is what happens when you don't give Wall Street the exact numbers it wants. All of that is standard corporate theater. Boring, predictable, and ultimately, not the point.

The real show, the one that mattered, was the Elon Musk desperation hour.

This wasn't a CEO calmly laying out a quarterly report. This was a man hijacking his own company's conference call to publicly plead for a one trillion dollar payday. He literally interrupted his own CFO, who was trying to wrap things up, to launch into a diatribe about his compensation and why he deserves "enough voting control." It was like watching a director shove the lead actor off the stage to deliver a monologue about how underappreciated he is. I could almost hear the collective sigh from the finance department through the phone line.

And his justification for attacking the proxy firms—ISS and Glass Lewis—who dared to question this gargantuan payout? He called them "corporate terrorists." Let's translate that from PR-speak to English. "Corporate terrorists" is what you call people who do their jobs and advise shareholders that maybe, just maybe, giving one man a compensation package larger than the GDP of most countries is a bad idea. This isn't a principled stand. No, 'principled' doesn't cover it—this is a tantrum disguised as a business strategy. What does it say about the state of your company when the main event of an earnings call is the CEO's personal financial grievance?

Look Over Here! A Shiny Robot!

When the narrative is turning against you, you don't change the facts; you change the subject. It’s the oldest trick in the book: the grand misdirection. While everyone is rightly focused on shrinking operating income (down 40%!), tariff headwinds, and a stock price that got nervous, Musk was waving his arms frantically, pointing at the future.

Look! A robot! The Optimus V3, he says, will be revealed in "February or March" and "won't even seem like a robot; it will seem like a person in a robot suit." What does that even mean? Is that a product spec or a line from a sci-fi B-movie? He admits they have no supply chain for it, that building a human-like hand is a massive engineering challenge, and that they're stuck in marathon weekend meetings just to figure it out. And yet, he's promising a production line capable of building a million of them by the end of 2026. A million. It's a number so big it feels fake, designed to short-circuit the part of your brain that deals with logic.

And if a million humanoid butlers don't do it for you, how about Robotaxis? They'll be operating in "eight to ten metro locations" by the end of this year. We've heard these promises for years. The FSD timelines are definately... flexible. It’s a perpetual motion machine of hype. The promises of tomorrow are always used to paper over the problems of today. It's a brilliant, if exhausting, performance. He's not selling cars anymore; he's selling a ticket to a future that's always just around the corner. This pivot was not lost on Wall Street, as CNBC noted that Elon Musk said Tesla’s robot will be ‘incredible surgeon,’ left Wall Street with no guidance on EVs.

Then again, maybe I'm the crazy one. Maybe in two years, we'll all have an Optimus bot folding our laundry while our Tesla drives us to work. But forgive me if I don't hold my breath. When a CEO spends more time talking about his paycheck and sci-fi projects than the core business that pays the bills, it feels less like visionary leadership and more like a desperate attempt to keep the plates spinning. And honestly, I'm just getting dizzy watching it.

So, This Is a Company, Not a Cult, Right?

I’ve listened to a lot of earnings calls. They’re usually a snoozefest of managed expectations and corporate jargon. This wasn’t that. This was a loyalty test. It was a high-stakes performance piece where the CEO of a publicly traded company put his own ego and fortune front and center, holding the company’s narrative hostage until his demands were met. The message was brutally simple: validate me, pay me, and I’ll keep delivering the dream. Question me, and you’re a "terrorist" standing in the way of progress. Forget the balance sheet; the only metric that seemed to matter on that call was the applause meter for one man.

Related Articles

Meta Stock Slides: Why a $16B Tax Hit and Future Spending Spooked Investors

It’s a familiar script on Wall Street, particularly in the lead-up to Big Tech earnings. Analysts li...

Super Micro's Stock Slide: What the Data Reveals About the Plunge and Its Outlook

It’s always the small tremors that precede the earthquake. For months, the market narrative around A...

Scott Bessent vs. an 'Unhinged' Chinese Official: The Full Story and Why It's a Bigger Deal Than You Think

So, let me get this straight. The entire global economic system, the intricate web of supply chains...

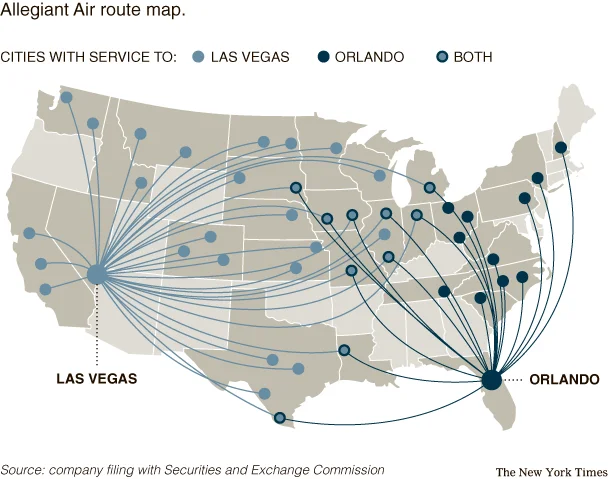

Allegiant Airlines Passenger Growth: What the 12.6% Surge Actually Means

More Passengers, Less Full Planes: Deconstructing Allegiant's Growth Paradox At first glance, news t...

The Social Security 'Rule' 90% of Americans Break: A Data-Driven Look at the Financial Logic

The financial advisory world operates on a set of elegant, mathematically sound principles. One of i...

Dodge Chrysler Jeep: Carvana's Next Power Play?

Generated Title: Carvana's Brick-and-Mortar Binge: Desperation Play or Calculated Gamble? Carvana, t...