Why DeFi's Post-Crash Numbers Don't Add Up (- Deep Dive)

The DeFi Landscape After the October 10th Crypto Crash

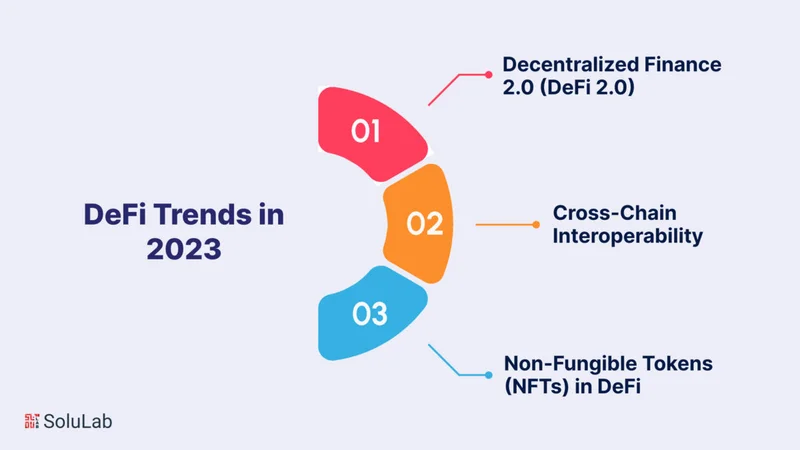

The October 10th crypto crash continues to cast a long shadow, particularly over the decentralized finance (DeFi) sector. FalconX data, as of November 20th, 2025, paints a stark picture: only 2 out of 23 leading DeFi tokens are showing positive year-to-date (YTD) returns. The group is down an average of 37% quarter-to-date (QTD). Ouch. That's not just a correction; that's a bloodbath. However, beneath the surface of this broad decline, a "flight to safety" is evident, but the definition of "safe" in DeFi is...well, let's just say it's unique.

Buybacks and "Idiosyncratic Catalysts"

The FalconX report highlights two interesting trends. First, investors are seemingly gravitating towards tokens with robust buyback programs. HYPE (down 16% QTD) and CAKE (down 12% QTD) are cited as examples of larger market cap names that have outperformed their peers, likely due to buyback support. Second, tokens with "fundamental catalysts" are also seeing relative strength. MORPHO (down 1%) and SYRUP (down 13%) are mentioned, owing to factors like limited exposure to the Stream Finance collapse or unique growth drivers.

Now, let's dissect this "flight to safety." Buybacks are essentially corporate (or in this case, protocol) actions to prop up the price of their own tokens. It's a signal, sure, but it's also a potentially artificial one. Are investors truly confident in the long-term prospects of these projects, or are they simply chasing short-term gains fueled by buyback-induced price pumps? And what happens when the buybacks stop?

The "idiosyncratic catalysts" are even more intriguing. Minimal impact from a competitor's failure? That's hardly a ringing endorsement. It's like saying a restaurant is doing well because the one next door burned down. These aren't exactly signs of fundamental strength; they're more like benefiting from someone else's misfortune. Are these really signs of safety, or just the appearance of safety in a volatile market?

Spot vs. Lending: A Multiples Game

The report also points to a divergence in valuation multiples across DeFi subsectors. Spot and perpetual decentralized exchanges (DEXes) have seen price-to-sales (P/S) multiples compress (price declining faster than protocol activity), while lending and yield names have generally seen their multiples increase (price declining less than fees). Some DEXes, like CRV, RUNE, and CAKE, have even posted higher 30-day fees as of November 20th compared to September 30th.

This suggests a shift in investor sentiment. The market seems to be punishing DEXes, perhaps anticipating lower trading volumes in a risk-off environment, while rewarding lending platforms, which are perceived as offering more stable yield opportunities. The idea is that in a downturn, investors will flock to stablecoins and seek yield, boosting lending activity.

But is this really the case? The fact that KMNO's market cap fell 13% while its fees declined a whopping 34% suggests that even in the lending sector, things aren't as rosy as they appear. The increased multiples could simply be a reflection of lower fees, not higher valuations. Investors may be "crowding" into lending names, as the report suggests, but that doesn't necessarily mean they're making a smart move. Crowded trades can quickly become unwound, leading to even steeper declines.

And this is the part of the report that I find genuinely puzzling. The underlying thesis of the "flight to safety" is that investors are becoming more risk-averse. But parking your money in DeFi lending platforms, even the "safer" ones, still carries significant risks, including smart contract vulnerabilities, impermanent loss, and regulatory uncertainty. It's like choosing to hide in a slightly sturdier cardboard box during a hurricane.

The Illusion of Stability

The Solana (SOL) blockchain provides an interesting, if slightly tangential, counterpoint. While not explicitly mentioned in the FalconX report, Solana's performance and ecosystem dynamics offer a broader perspective on the DeFi landscape. Data from December 2025 reveals Solana maintains high throughput (1,000+ TPS) and a growing DeFi and NFT ecosystem. However, even Solana, with its relatively low transaction fees (around $0.00025), is subject to market volatility and regulatory pressures. More information on Solana's investment potential can be found in "Solana Price Prediction: Is Solana a Good Investment?".

Ultimately, the "flight to safety" in DeFi is more of a "flight to perceived safety." Investors are seeking out assets that appear less risky, but the reality is that all DeFi protocols are inherently more volatile than traditional financial instruments. The key takeaway here is that even in a downturn, investors are still willing to take on some risk, but they're becoming more selective about where they put their money.

The FalconX report suggests investors expect perps to lead DEX growth, and fintech integrations to drive lending growth in 2026. The cheapening in the DEX sector may be warranted on lower growth expectations, but it's important to remember that these are just expectations. The future is uncertain, especially in the world of DeFi.

"Safe" is a Moving Target

The "striking dichotomy" in DeFi tokens isn't just about performance; it's about perception. It's about investors trying to find stability in a fundamentally unstable environment. It's about chasing yield in a world of zero interest rates. It's about believing that you can outsmart the market, even when the market is telling you that everyone is getting rekt. As Coindesk reported in late November 2025, this dichotomy is a key factor in understanding current DeFi trends; read more in "The Striking Dichotomy in DeFi Tokens Pos

Previous Post:Ethereum's Fusaka 'Upgrade': What They're Selling & What You're Actually Getting

No newer articles...

Related Articles

Concordium ($CCD) Lists on Kraken: What the Listing Reveals About Its 'Compliance-First' Strategy

The Quiet Bet on Boring: Deconstructing Concordium's Institutional Play Another day, another token l...

B&M Recalls Harvest Mug: Why Your 'Cozy' Fall Mug Might Just Explode

So let me get this straight. The primary, singular, unassailable function of a mug is to hold hot li...

Balancer Hacked: $110M Moved – What We Know and the Internet's Reactions

Balancer's $110M Hack: A Wake-Up Call or DeFi's Ultimate Stress Test? Okay, folks, let's dive into t...

Solana's Bull Party is Over: What Happened?

Okay, so Solana crapped the bed yesterday. Broke below some "upward trendline" from April, and now e...

Polymarket Rebound: What's Driving the Surge?

The Rise of Polymarket: How Shayne Coplan is Betting on the Future—and Winning Shayne Coplan. Rememb...

Beldex: Your Identity & Access Layer in the Confidential Web – Seriously?

Beldex's BNS: Another "Decentralized" Dream or a Real Privacy Revolution? Okay, Beldex Name Service...